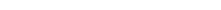

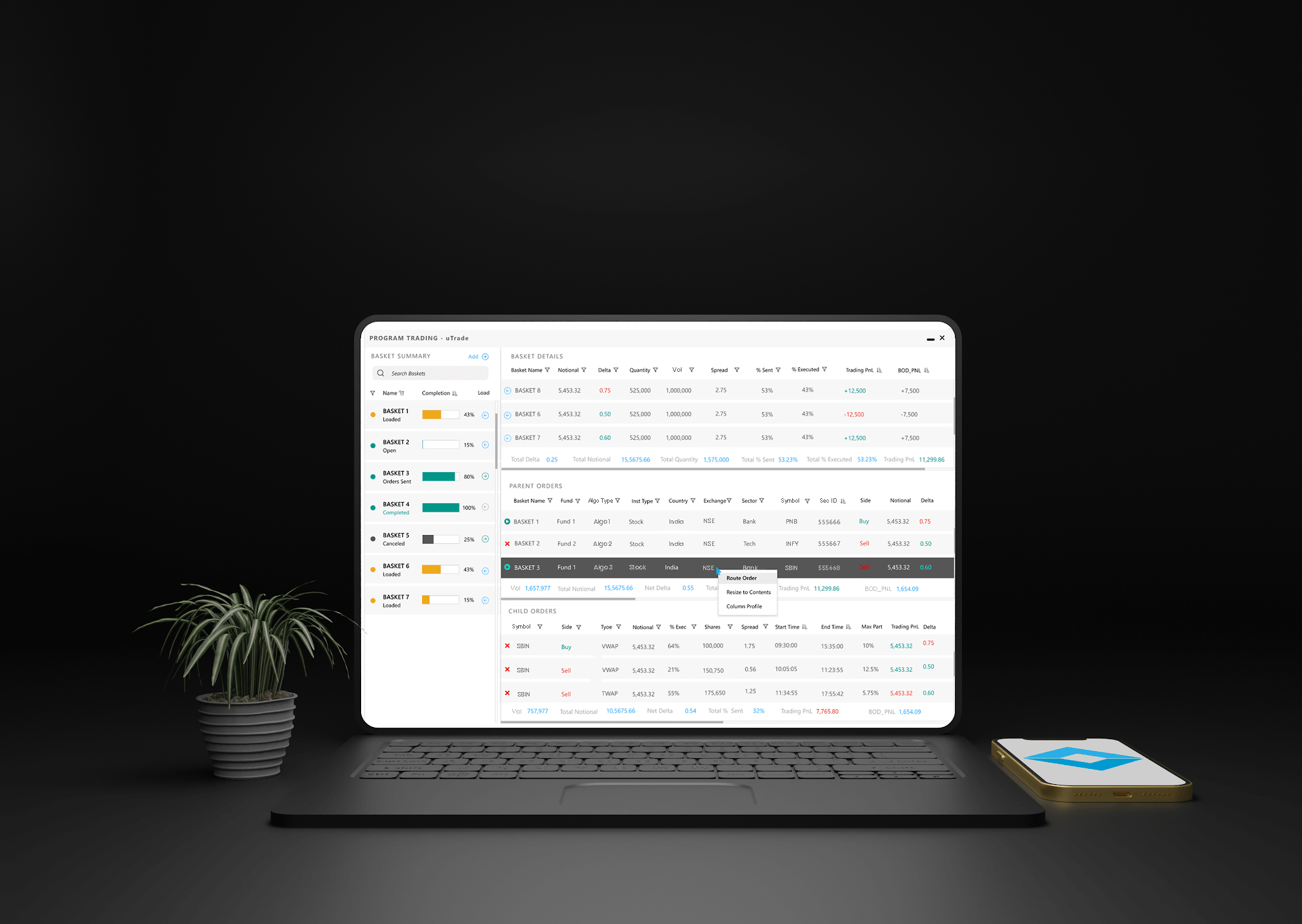

uTrade Buy Side EMS for Broker Neutral, Multi Asset Execution

Built For Asset Managers and the Complex Range of Trading

Functions They Execute Everyday

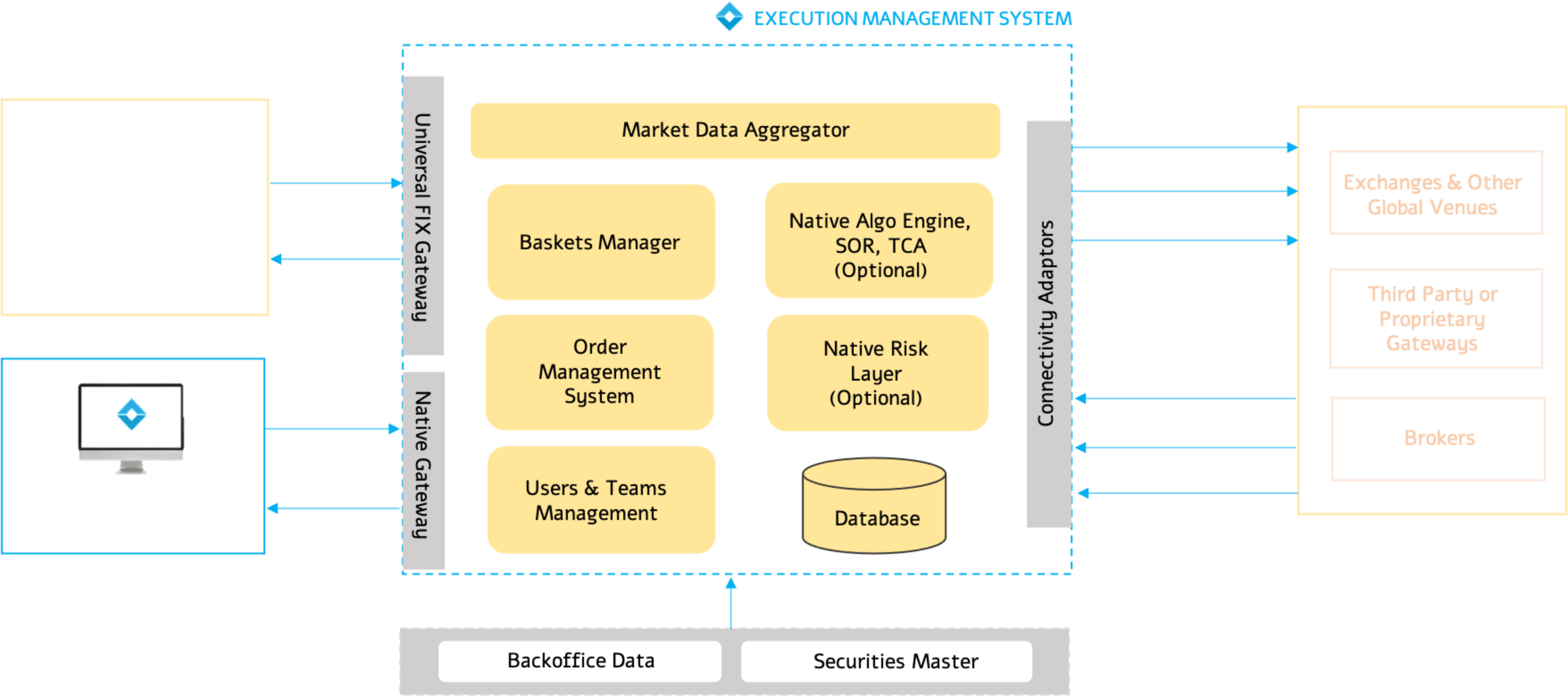

uTrade EMS is a multi-asset, multi-market solution for managing

increasingly complex trading functions performed by asset managers.

It integrates easily with your OMS, proprietary gateways and

databases - allowing you to seamlessly import orders, route them to

desired execution destinations, and also export fills back to

proprietary or third party OMS applications if needed. The EMS

enables you to analyze aggregated market data, sourced from dozens

of global exchanges in real-time.

Trade Bigger, Better and Wider.

Precise Execution

We understand that each basis point is precious, and pack

in-built suite of execution algos, risk management and TCA so

your teams achieve the best execution prices for each basket.

Risk Capabilities

Use uTrade’s native risk management system to administer trading

risk, including limits and margins. Also get access to

surveillance dashboards to stay updated with your team’s

activities in real-time.

Universal FIX Gateway

Manage order flow seamlessly with different brokers,

applications, gateways and trading destinations with our popular

FIX engine that delivers wide connectivity capabilities with

minimum latency.

Algorithms & APIs

Leverage uTrade’s native algo engine, smart order routing,

transaction reporting & analysis, custom algo APIs and deep

connectivity with any of your preferred black box trading

engines.

FROM THE BLOG

Asset Managers: Ready to Upgrade your EMS?

EMS (Execution Management System) is a specialized application suite

built for buy side fund managers and traders to access real-time

market data and provide fast, seamless to trading destinations

including brokers, stock exchanges and proprietary gateways. With

trading desks continuing the trend of consolidation, they are

striving to find a trading solution that’s both fit-for-purpose for

today’s challenges, but flexible and nimble enough to meet future

needs as the markets we trade and how we trade them continue to

evolve as a response to increasing innovative technology

requirements, evolving regulations, and ability to tap into market

opportunities.

Read More