uTrade delivers

Ultra Low Latency

Global DMA Technology

Tailored for how your business needs it.

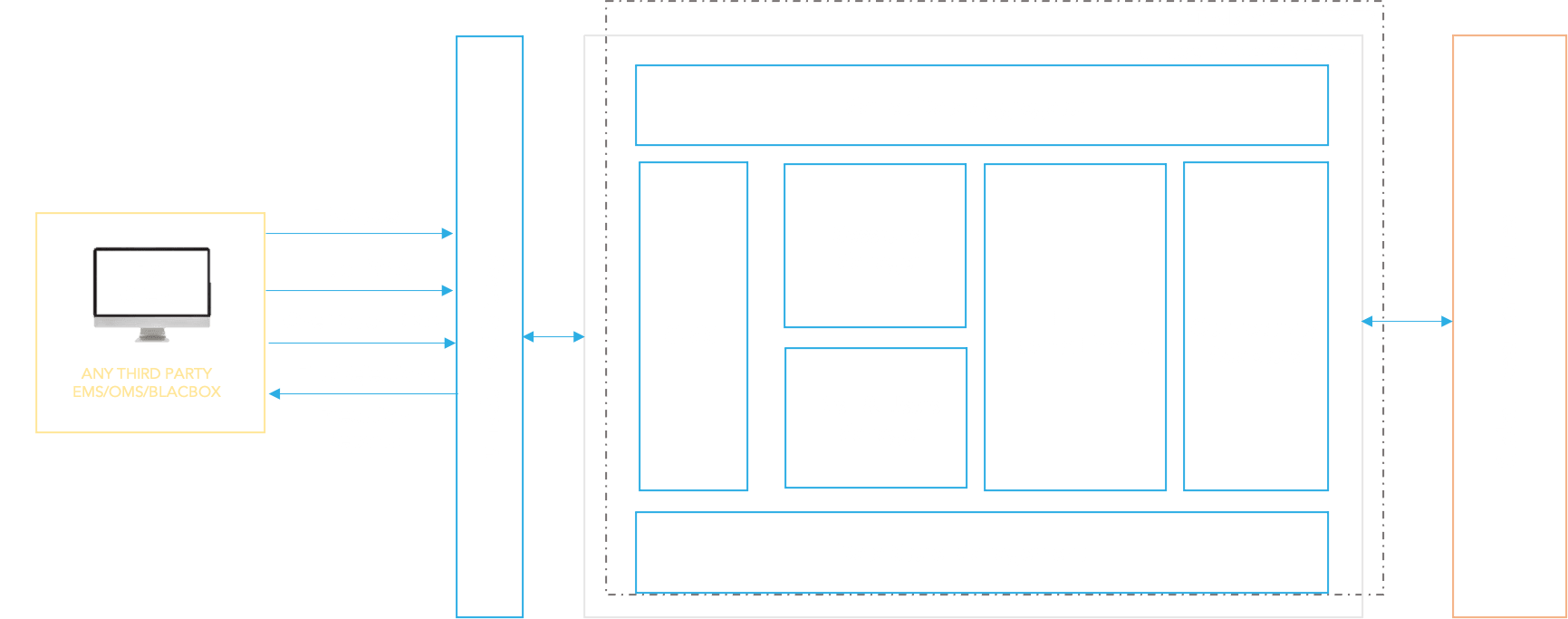

Any FIX enabled trading workstation

Any trading destination.

One uTrade API.

What can You do with uTrade DMA API Kit?

Engage clients and users

Our Universal FIX Gateway lets you enable trading workflows for

your clients using any execution systems (including Bloomberg,

Refinitiv, Fidessa and others), over multiple channels like FIX

4.2, FIX 4.4, FIX 5.0 - and more on request.

Route orders, even faster

Whether your users are running latency sensitive algorithms, or

simply trying to catch the best market prices - uTrade’s ultra

low latency DMA engine will help them do it faster.

Manage financial risk

Comprehensive risk management, surveillance and order management

comes easy with uTrade DMA systems, loaded with hundreds of

configurations for you to choose from.

Access global markets

uTrade can help you connect with all major Stock exchanges,

gateways, dark pools, private liquidity pools of your choice.

FROM THE BLOG

A Deeper Understanding of DMA

Direct market access (DMA) refers to a method of electronic trading

where investors can execute trades by directly interacting with an

electronic order book, which records the orders that buyers and

sellers place in the stock exchange. DMA service allows a trading

firm to route their orders to an exchange while using their own

trading platform and connecting to the exchange via a broker

software solution. You can easily add and support all your trading

divisions & teams on a single centralized trading system with

uTrade.

Read More